In every major city, Americans are facing huge costs of rent, healthcare, childcare, and groceries, which aren’t being matched with higher incomes.

If you live in the Bronx, your income doesn’t come close to covering your NYC costs.

New data analysis shows that the Bronx is the most expensive place to live in America when looking at how much people make versus how much they are expected to pay for daily necessities. In this article, I look at regions with low incomes and evaluate this against the high costs of rent, healthcare, childcare, and food. This data shows us how relatively expensive it can be to survive in different parts of America.

Yalikhan Traore knows the challenges of high costs coupled with low wages in the Bronx.

Without enough money to do laundry, she washes her clothes in her bathtub.

Without enough money to buy food, she pools her income with her roommate so they can buy rice, beans and eggs from their local grocery store.

Without enough money to afford her $600 rent, she quit her dream job and started delivering packages for $17 per hour.

“Everything has a cost in New York,” said Yalikhan, a reality she quickly learned after immigrating from Guinea 3 years ago. “It’s hard, it’s really hard — especially if you have no savings.”

Median income in the Bronx is $41,470, but residents here pay $27,156 for a 2-bedroom, $17,739 for childcare, $3,206 for groceries, and $15,394 for healthcare, according to median data I compiled from the USDA, HUD, the Bureau of Economic Analysis, and the Center for Medicare and Medicaid Services. This means that every year, Bronx residents are stuck with over $22,000 in debt. We have created a system where people in some parts of the country are not making enough to survive.

We cannot only look at income inequality without thinking about how much that income is actually needed in certain areas.

How did we get here?

The income inequality debate for the last 6 decades has focused on the idea of a “living wage” — What amount is needed for Americans to actually live in our world today? In 1964, an economist at the Social Security Administration named Mollie Orshansky helped develop the notion of the living wage, arguing “If it is not possible to state unequivocally ‘how much is enough,’ it should be possible to assert with confidence how much, on an average, is too little.”

In 1969, Orshansky developed the de facto guideline for federal poverty minimums. That number hasn’t been recalculated since. Instead, it has been adjusted according to the Consumer Price Index, or a measure of inflation, to match rising costs.

The U.S. federal minimum wage is a meager $7.25. FDR established the first minimum wage in 1938 at $0.25 cents ( $4.77 in today’s dollars) to assist during the Great Depression. The current level of $7.25 was established in 2009 amidst the panic of the Great Recession.

29 states have minimum wages above $7.25, though high costs in these regions make this wage still too low. MIT’s Living Wage Calculator estimates that if two parents in the Bronx both work and are trying to raise two kids, they would each need to make at least $25.52 per hour to cover their everyday costs like rent, healthcare, childcare, and food. Nearly 70% of families in the Bronx with 1 child make below this living wage. On July 1st, New York’s minimum wage became $15.

One of the primary arguments against raising the minimum wage is that it would increase unemployment. The Congressional Budget Office estimates that 1.4 million jobs would be lost from a $15 minimum wage — The argument goes that, with a fixed pie, employers would have to lay off workers to maintain their other workers at a higher rate. In the same paragraph though, the CBO also estimates that it would lift nearly 1 million people out of poverty and increase pay for low-income earners by $504 billion.

Highest Costs of Living - CA, VA, MA, TX

Rent

San Francisco is the county with the highest median rent in America. Residents here pay $44,410 annually for a 2 bedroom ($3,701 per month). However, Bronx residents pay the greatest share of their income on rent at 66%. HUD warns that your rent should not exceed 30% of your household budget, yet half of all Americans consistently break this rule.

Healthcare

Kenedy, TX is the county with the highest median healthcare costs in America. Residents here pay $33,471 annually for healthcare, or 72.5% of their total income on healthcare, the highest percentage nationwide. The county also is in the bottom 10% for male life expectancy in the US.

Groceries

Fairfax County, VA is the county with the highest cost of groceries in America. Residents here pay $9,440 for groceries ($181 per week). The USDA has created 4 tiers of grocery budget plans, and even in their cheapest “thrifty” plan, they say that a couple should spend no more than $95 per week on groceries, and a family of 4 should spend no more than $159 per week. Even under the most stringent budgets, Fairfax families are still overpaying. Nevertheless, the median income in Fairfax is $111,000.

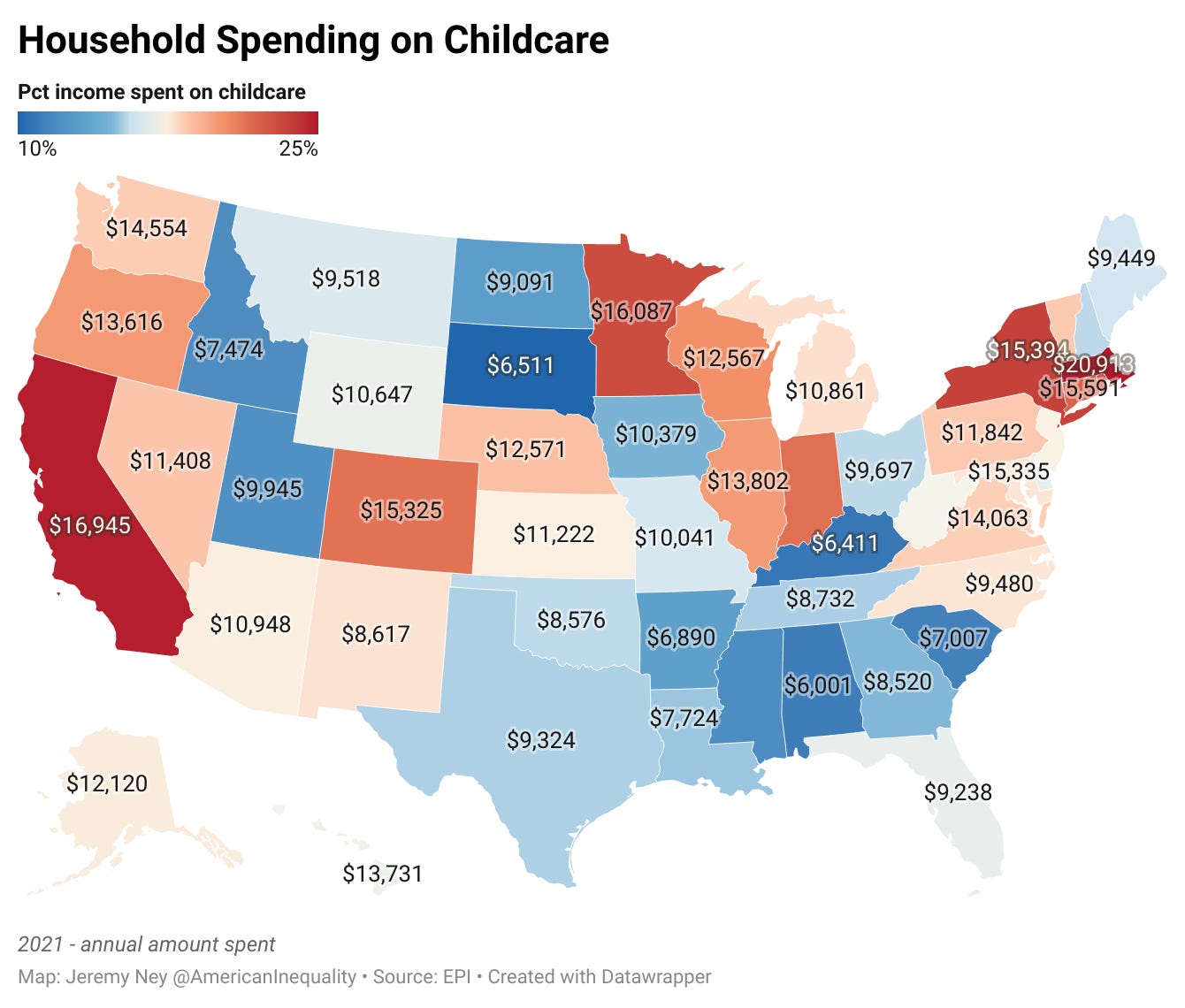

Childcare

Massachusetts is the state with the highest cost of childcare. Residents here pay $20,913 for childcare. Most researchers, financial planners, and the Department of Health and Human Services estimate that childcare should not exceed 10% of your household budget, meaning if you aren’t making above $200,000 in MA, you are out of luck. In 33 states, the cost of infant care exceeded the average cost of in-state college tuition at a public 4-year institution.

The Path Forward

Increase the Earned Income Tax Credit — The EITC is a fantastic tool for problems like this. First, the EITC is paid out as a lump sum of cash and isn’t tied to a specific challenge like housing vouchers or SNAP benefits. As such, this solution can help people struggling with housing or childcare or food. Second, the EITC supports families and provides additional funds for children. Larger families will have to pay more in rent, buy more food, and spend more on childcare, and thus the EITC is specifically designed to help families in need.

Reform Single Family Zoning — Rent is the largest percentage of a person’s budget and is thus the biggest contributor to the relative cost of living and inequality. However, local zoning regulations prohibit building anything other than single-family detached houses on three-quarters of land in major U.S. cities. Minneapolis, Minnesota has been a pioneer in this space with its Minneapolis 2040 Plan. Passed in 2019, the policy removes requirements on single family housing across the city and is expected to triple housing availability for low-income families in a move that The New York Times called “simple and brilliant.”

As helpful as the Minneapolis 2040 plan is expected to be, Michelle Belmont is struggling in the meantime. A long-time resident of Minneapolis, she pays $1,300 per month in rent, which was manageable until her son, Eamon, got sick. After two surgeries, Michelle’s bills piled up on the kitchen table. Michelle looked out her window and lamented:

“We always had money for food before, but now it’s, ‘How are we going to eat?’ I’ll borrow from one credit card to pay the other. I can’t find rent money each paycheck, and we make a decent salary between us.”

The combination of rent, healthcare, groceries, and childcare have meant that Michelle’s debt has now hit six figures.

Download the data and check out the insights here: https://www.americaninequality.io/cost-of-living