Tax Filing and Inequality

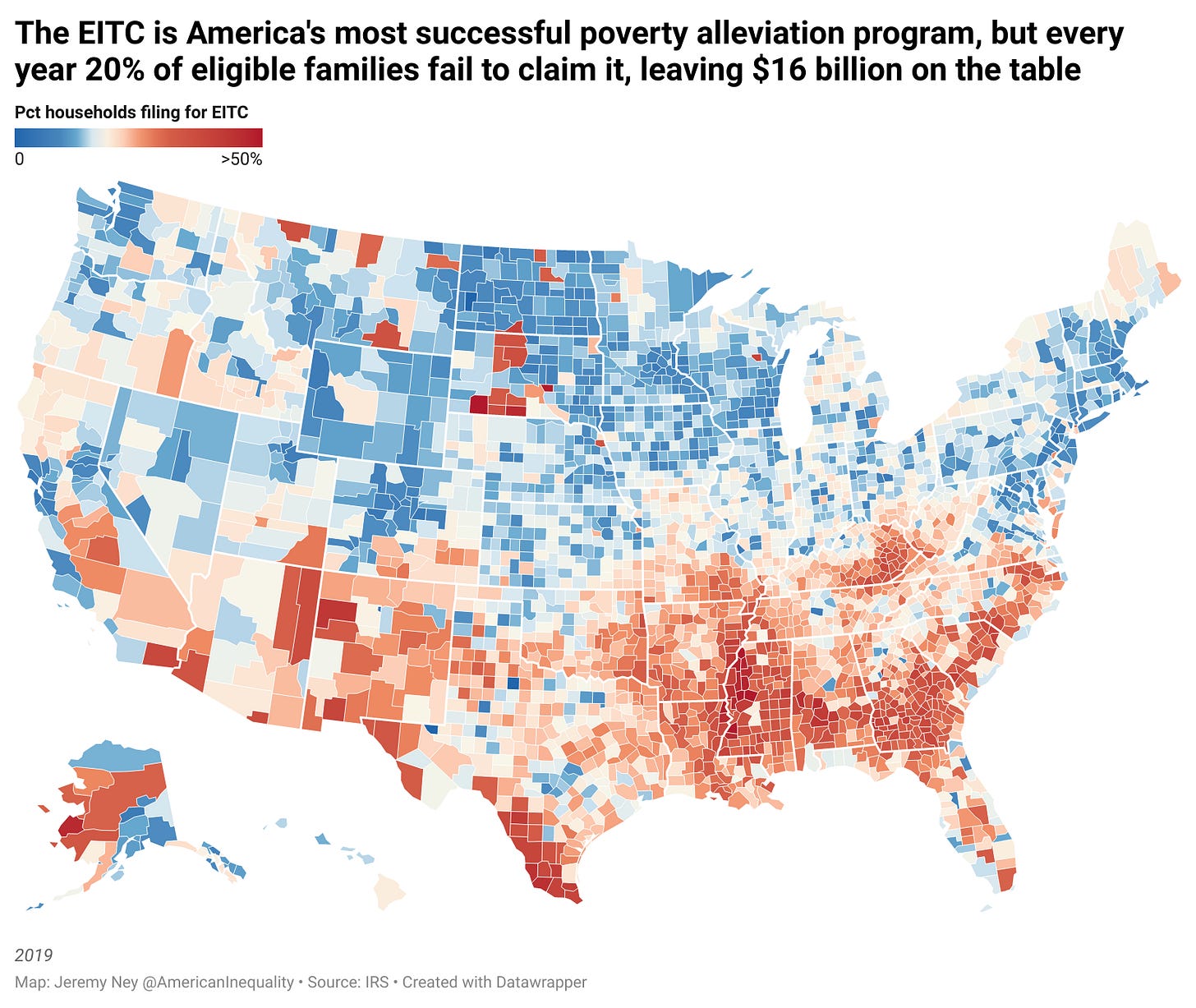

The Earned Income Tax Credit (EITC) is America's most successful poverty alleviation program, but too few families actually claim this benefit. Happy Tax Day.

I volunteer to help low-income families file their taxes and so I’ve met some interesting people along the way. I remember working through finances with one mother last year.

Macy dumped every single piece of paper and receipt she had on the desk. Two children, single-income home, student debt, credit card debt. She made $43,000 last year as a nurse outside of Boston. Macy filed her taxes with TurboTax last year, felt like she was messing up the whole time, and got charged $100 at the end. The year before that, she filed her taxes over the phone using a company that an Instagram-influencer had recommended and paid $1,000 for it. This time, she decided to try something different. When we were almost ready to send her taxes off to the IRS and get her $4,000 refund, she asked if she could be the one to click submit. I pushed the keyboard over to her. We high-fived.

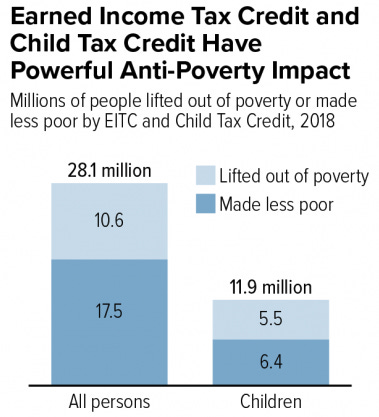

The Earned Income Tax Credit (EITC) lifted 5.8 million people out of poverty in 2018, 3 million of whom were children. The policy has been around since 1975 and has been expanded by both Republicans and Democrats alike — Obama expanded the EITC after the 2008 financial crisis to support families hurt by the economic downturn, and Trump expanded it in 2016 to focus on helping low-income families with children.

However, the EITC remains highly underutilized. More than 20% of people who are eligible for the EITC fail to claim it. The average family will get $3,191 in EITC benefits, effectively boosting wages by $266 per month. When families fail to claim, billions of dollars are left on the table every year which just get recycled back into the Treasury.

While the chart above shows us where the most people in the US are filing for the EITC, it does not tell us where people should be filing.

Imperial County, California has the lowest rate of people claiming the EITC who should be, largely because many immigrant families are afraid of how their information will be used. Imperial County is home to 150,000 residents, 84% are Latinx and the median income is $44,000. In 2017, ICE Director Thomas Homan told a House appropriations subcommittee, “And by me saying you should be worried, you should be afraid. If you lie on your taxes, you got to be worried, is the IRS going to audit me?” The IRS is not allowed to share any information with ICE, but Homan’s comments rippled through communities. 30% of eligible residents in Imperial don’t claim the EITC.

Despite everything you’ve been told, the US actually has a regressive tax system. In their book, The Triumph of Injustice, Emmanuel Saez and Gabriel Zucman show that the richest 400 Americans have an effective tax rate of 24%, which is the same tax rate that a middle-income family pays too. Instead of increasing the tax rate as people get wealthier, Saez and Zucman found the taxation curve actually slopes downward after a certain point. The inflection point has been steadily changing since Reagan’s 1981 tax cuts.

Not only is our tax system more regressive than people think, but so too is the IRS auditing system. Pro Publica found that “last year, the top 1% of taxpayers by income were audited at a rate of 1.56%. EITC recipients, who typically have annual income under $20,000, were audited at a rate of 1.41%.” This means that the IRS cracks down on low-income families at the same rate that it does on millionaires.

Senator Ron Wyden (D-OR), the ranking member of the Senate Finance Committee, summed this up clearly — “We have two tax systems in this country and nothing illustrates that better than the IRS ignoring wealthy tax cheats while penalizing low-income workers over small mistakes.” IRS spokesman Dean Patterson acknowledged that the sharp decline in audits of the wealthy is due to budget cuts and the loss of IRS auditors. And he didn’t dispute that pursuing the poor is just easier.

Imperial County, CA stands in stark contrast to Rockwall County, TX where wealthy Americans pay few taxes. Not only does Texas have no income tax, but residents of Rockwall pay 0.38% in property taxes (San Francisco residents pay triple that), making it one of the lowest in the country. The median income in Rockwall is more than double that of Imperial. Residents of Rockwall are 72% White.

Taxes are complicated, but once you have a child, they get even trickier. If you are a single mother making $20,000 and just had your first child, you are eligible to receive $5,900 in EITC credits, or 30% of your total annual income. This means that tax time can be a tremendous boost for low-income families.

Challenges to claiming the EITC

Why don’t more people claim the EITC if it is so helpful? The answer to this question is tied up in several factors.

First, researchers at Stanford Law School suggest that take-up of the EITC is actually higher amongst those families who have the most to gain from it. In other words, households that may only get a few hundred dollars from the EITC are more likely to skip over it than those families who would be getting thousands-of-dollars.

Second, the requirements are complicated. While the IRS has tried to outline the various qualifications, many families are unsure who qualifies as a ‘dependent’ for the EITC. If a teenage mom lives with her parents to help with childcare needs, is her baby the dependent or is she the dependent?

Third, many families lack proper tax support. Predatory tax filers often take advantage of low-income families who don’t know where to turn — a GAO study found that between 89%-94% of EITC tax returns filed by paid-preparers in 2015 had errors. Vulnerable communities need extra tax support and must be funneled toward the right resources.

The Path Forward

The 16th Amendment gave Congress the power to collect federal taxes in 1913 and since then people have been figuring out how taxes really work. While this article cannot go in depth on how to reduce tax code complexity, two possible solutions exist to reduce inequality in our tax filing system. First, automatic tax filing could entail sending out pre-filled 1040s to households with simple tax filing statuses based on information that the IRS already has. Second, free-filing information could be more easily provided so that low-income families in particular can avoid predatory filers and exorbitant fees.

Automatically prepare returns for people with simple taxes — The American system of tax filing can reduce the burden placed on individuals for filing their taxes. When the IRS checks if you have filed taxes correctly, they validate this information against the information that your employer, your bank, and other sources have already sent to them. While this would likely only work for people with simple tax situations, Austin Goolsbee at Brookings estimates that 40% of Americans would qualify for this ‘Simple Return’ process, saving 225 million hours each year, reducing $2 billion in tax fees, and increasing taxes collected by $36 million each year. This is already the practice in Spain, Sweden, and Denmark. In 2005–2006, California ran a pilot of this with great success, saving millions in auditing costs, reducing hours spent by citizens, and increasing tax revenue for the government.

Unfortunately, Grover Norquist and tax lobbyists have made it nearly impossible to pass such legislation since it would disrupt the multi-billion dollar tax filing industry. Intuit spends more on lobbying each year than do Apple or Amazon. Tax software companies made over $1 billion in revenue in 2019 off of people who should have been filing taxes for free.

Increase access to tax volunteers — 70% of Americans qualify for free tax filing, but only 3% of them actually take advantage of this. The use of free tax preparers can actually be more accurate than paid prepares, with studies showing that paid preparers make errors 49% of the time, compared to volunteers which only make errors 11% of the time. The average cost of paying taxes is $242, but this can be far lower if more people took advantage of the paid options. Many Americans don’t know that free filing exists, and this fact is often hidden intentionally. In 2019, TurboTax hid its free file site by unindexing it from Google — this meant that if you searched for “TurboTax Free File” or similar, nothing would come up. Even fewer Americans know about the Volunteer Income Tax Assistance (VITA) program administered by the IRS. 5 million Americans relied on VITA last year to help them file tax their tax returns, but far more are eligible.

Fortunately, President Biden’s new tax changes will have incredible benefits for low-income families. The Child Tax Credit (CTC — which has a 98% filing correlation with the EITC) is increasing from $2,000 to $3,000 and filers can now use a “look-back” clause to help them claim the EITC based on past income, even if they had no job losses related to the COVID-19 pandemic. This means that a single mother with two children earning $22,000 per year (which means she is earning above the minimum wage) can get $11,920 from the EITC + CTC - more than half her annual income.

We need to get Americans the credits they’ve earned. If the IRS will not send people ‘Simple Returns’ with their pre-filled-out tax returns, then they should at least do more to ensure that people can file their taxes for free. The IRS Free File page is a good place to start to learn more about options, and the VITA locator is even better. But these all fall short.

That was why I co-founded Let’s Get Set, which helps low-income families file their taxes for free, claim the EITC and other tax credits, and then deploy their refunds to hit savings goals. To date, we’ve helped 150 families get over $350,000 in tax refunds, which they’re now using to save for their children’s education or to buy new homes.

While the US tax code may take decades to overhaul, we can take steps today to improve access to the EITC, to make it easier to avoid predatory tax preparers, and to get volunteer support that ensures every family gets their maximum refund.