ICE access to IRS may gut America’s best anti-poverty program

Billions in tax credits to low-income families may go unclaimed due to the fear immigrant families now face

Share this newsletter with a friend and listen to the Podcast version of this article.

INTERESTING ON THE WEB

Millions of Americans marched this weekend to protest the policies covered in this article and more. Photos - LINK

NYTimes launched a series for sharing stories on financial dilemmas to “hold institutions to account.” Send yours in at the bottom - LINK

Gun deaths rose in states that loosened gun laws, from my friend Onyeka in the NYTimes and JAMA - LINK

Humans for Housing created a toolkit for communities to address the homelessness crisis, including some of our research - LINK

How one city cut its poverty rate in half - LINK

Tax revenue could drop by 10% amid DOGE cuts at the IRS - LINK

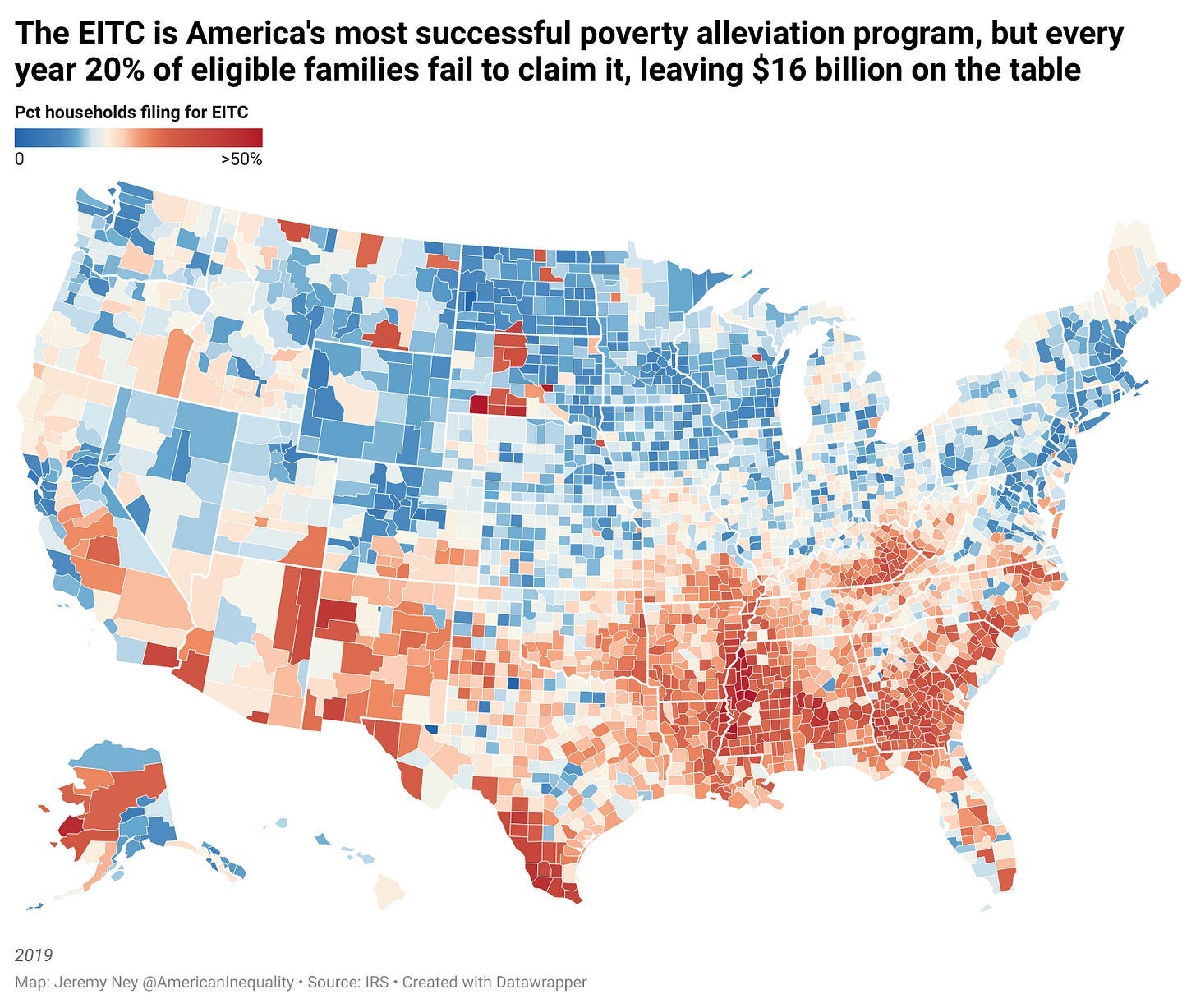

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are America's most successful poverty alleviation programs, but too few families actually claim this benefit.

For millions of Americans, tax time is a source of incredible joy. I used to volunteer to help low-income families file their taxes in Boston and I remember people talking about tax season like “second Christmas” because they may get thousands of dollars in refunds through generous tax credits.

This tax season though, the IRS reached an agreement to allow immigration officials at ICE to access confidential tax databases to confirm the names and addresses of people suspected of being in the country illegally. This led to the resignation of the acting IRS commissioner. The move from President Trump would dramatically decrease the number of people filing taxes, both decreasing government revenue and the share of people who might rise up out of poverty because of the EITC and CTC. As the Washington Post explained, “It would be unusual, if not unprecedented, for taxpayer privacy law exceptions to be used to justify cooperation with immigration enforcement.”

Undocumented immigrants do file taxes, in large part because they earn income and because a provable history of paying taxes is seen as one way to show good faith and may someday help them become citizens. As one IRS official said, “This is a complete betrayal of 30 years of the government telling immigrants to file their taxes.” Undocumented immigrants paid nearly $97 billion in federal, state and local taxes in 2022, according to a July 2024 report by the Institute on Taxation and Economic Policy (ITEP), which used data on taxpayers with ITINs to estimate tax revenue.

Initial estimates suggest that every 10-percentage point drop in the income tax compliance rate of undocumented immigrants would lower federal tax revenue by $8.6 billion per year, and state and local tax collections by $900 million per year.

Last month, IRS leadership rejected a DHS request for the names, addresses, phone numbers and email addresses of 700,000 people the Trump administration suspected of being in the country illegally.

Second Christmas

I remember working through finances with one mother who dumped every single piece of paper and receipt she had on the desk. Two children, single-income home, student debt, credit card debt. She made $43,000 as a nurse. Macy filed her taxes with TurboTax last year, felt like she was messing up the whole time, and got charged $100 at the end. The year before that, she filed her taxes over the phone using a company that an Instagram-influencer had recommended and paid $1,000 for it. This time, she decided to try something different. When we were almost ready to send her taxes off to the IRS and get her $4,000 refund, she asked if she could be the one to click submit. I pushed the keyboard over to her. We high-fived.

While the chart above shows us where the most people in the US are filing for the EITC, it does not tell us where people should be filing.

Imperial County, California has the lowest rate of people claiming the EITC who should be, largely because many immigrant families are afraid of how their information will be used. Imperial County is home to 150,000 residents, 84% are Hispanic and the median income is $44,000. In 2017, ICE Director Thomas Homan told a House appropriations subcommittee, “And by me saying you should be worried, you should be afraid. If you lie on your taxes, you got to be worried, and ask yourself, is the IRS going to audit me?” The IRS is not allowed to share any information with ICE, but Homan’s comments rippled through communities. 30% of eligible residents in Imperial don’t claim the EITC.

The Best Poverty Alleviation Programs in America

The EITC and CTC, which were both expanded in 2021, lifted 9.6 million people out of poverty. In 2022, together these programs lifted another 6.4 million people out of poverty. As the Tax Policy Center explains, “The EITC is the single most effective means tested federal antipoverty program for working-age households—providing additional income and boosting employment for low-income workers.”

The policy has been around since 1975 and has been expanded by both Republicans and Democrats alike — Obama expanded the EITC after the 2008 financial crisis to support families hurt by the economic downturn, and Trump expanded it in 2016 to focus on helping low-income families with children and Biden expanded it again during the pandemic.

However, the EITC remains highly underutilized. More than 20% of people who are eligible for the EITC fail to claim it. The average family will get $3,191 in EITC benefits, effectively boosting wages by $266 per month. When families fail to claim, billions of dollars are left on the table every year which just get recycled back into the Treasury.

Aren’t taxes progressive?

Despite everything you’ve been told, the US actually has a regressive tax system. In their book, The Triumph of Injustice, Emmanuel Saez and Gabriel Zucman show that the richest 400 Americans have an effective tax rate of 24%, which is the same tax rate that a middle-income family pays too. Instead of increasing the tax rate as people get wealthier, Saez and Zucman found the taxation curve actually slopes downward after a certain point. The inflection point has been steadily changing since Reagan’s 1981 tax cuts.

Not only is our tax system more regressive than people think, but so too is the IRS auditing system. ProPublica found that “last year, the top 1% of taxpayers by income were audited at a rate of 1.56%. EITC recipients, who typically have annual income under $20,000, were audited at a rate of 1.41%.” This means that the IRS cracks down on low-income families at the same rate that it does on millionaires.

Senator Ron Wyden (D-OR), the ranking member of the Senate Finance Committee, summed this up clearly — “We have two tax systems in this country and nothing illustrates that better than the IRS ignoring wealthy tax cheats while penalizing low-income workers over small mistakes.”

IRS spokesman Dean Patterson acknowledged that the sharp decline in audits of the wealthy is due to budget cuts and the loss of IRS auditors. And he didn’t dispute that pursuing the poor is just easier.

Challenges to claiming the EITC

Why don’t more people claim the EITC if it is so helpful? The answer to this question is tied up in several factors.

First, researchers at Stanford Law School suggest that take-up of the EITC is actually higher amongst those families who have the most to gain from it. In other words, households that may only get a few hundred dollars from the EITC are more likely to skip over it than those families who would be getting thousands-of-dollars.

Second, the requirements are complicated. While the IRS has tried to outline the various qualifications, many families are unsure who qualifies as a ‘dependent’ for the EITC. If a teenage mom lives with her parents to help with childcare needs, is her baby the dependent or is she the dependent?

Third, many families lack proper tax support. Predatory tax filers often take advantage of low-income families who don’t know where to turn — a GAO study found that between 89%-94% of EITC tax returns filed by paid-preparers in 2015 had errors. Vulnerable communities need extra tax support and must be funneled toward the right resources.

The Path Forward

The 16th Amendment gave Congress the power to collect federal taxes in 1913 and since then people have been figuring out how taxes really work. While this article cannot go in depth on how to reduce tax code complexity, two possible solutions exist to reduce inequality in our tax filing system.

Keep reading with a 7-day free trial

Subscribe to American Inequality to keep reading this post and get 7 days of free access to the full post archives.