Breaking the Bank: Eggs, Inflation, and the Unbearable Cost of Living

How inflation is pushing inequality to new heights

Listen to the podcast version of this article recorded with NotebookLM. Share the newsletter with a friend.

🎉 American Inequality has hit 15,000 email subscribers and more than half a million readers all time! 🎉

Eggs are Eggspensive

The cost of eggs is too high. Before the pandemic, the cost of a dozen eggs was $1.53 on average across the US. As of October 2024, the cost has more than doubled to $3.53. Even adjusting for inflation, the cost of eggs has gone up 50% in the last year. This one product seemed to be a rallying point for how expensive everyday goods had become in America (perhaps because Americans ate more eggs in this past year than they ever had before, at 279 per person per year). But certain regions in the US felt these rising costs more than others, and it might explain why some people’s views of the country are shifting.

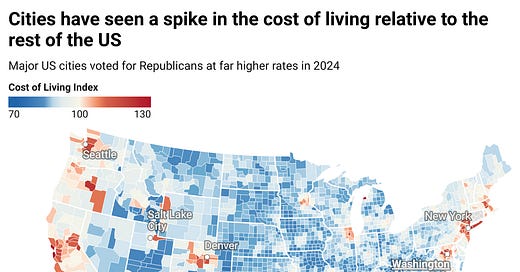

8 of the 10 most expensive counties in America are major metropolitan areas. New York City. San Francisco. The DC area. You don’t need a data scientist to tell you that living in New York City is going to be more expensive than in Jackson, Mississippi. However, the Bureau of Economic Analysis just published this county level data mapped above for the first time ever, revealing what might be happening outside of our traditional views of the country.

New data and the view from Michigan

The new dataset looks at 3 categories of costs - housing, utilities, and goods and services. Goods include food prices by place and the average cost of a meal in that area. The researchers use a ‘basket of goods’ approach which basically looks like filling a giant shopping cart of groceries in every single county in America and figuring out how much the prices differ in each region (i.e. how expensive was this carton of milk, box of cereal, ground beef, in Mobile, Alabama vs. Anchorage, Alaska).

The major categories of cost of living includes groceries, housing, education, childcare, and healthcare costs. We’ve done a survey of all of these in the past so today I’m just going to deep-dive into groceries and housing because they have become flashpoints in American politics.

Leelanau County, Michigan has the lowest purchasing power of any county in America. Located at the pinky of the mitten of Michigan, this region of 22,000 residents is very difficult to get to, increasing transportation and import costs. These two factors are some of the most significant drivers of increased grocery costs across the US. Strangely enough, for all of the counties in Michigan north of Grand Rapids, Leelanau was one of only two to go for Kamala Harris in the 2024 presidential election. For many Trump-voting Americans, their purchasing power and the cost of living seemed to be the biggest factor behind their votes.

Ty Wessell has been writing a column called ‘Invisible Leelanau’ for nearly a decade. Ty writes about people who are referred to as ALICE’s - Asset Limited, Income Constrained, Employed. The community has jobs, but 43% can’t afford a $1,000 emergency expense. Amidst the pristine blue lakes and expansive farms, young mothers and dads wait tables and repair cars to avoid slipping deeper into poverty.

Cities swing Right

In the map above, we can see the cities have become far more expensive relative to changes in other parts of the US. This may explain why republicans saw double-digit gains in every major American city. 19 points in Miami-Dade County, 16 points in New York City, 14 points in Los Angeles County, 12 in Suffolk County (Boston), 11 points in Cook County (Chicago), 10 in Dallas County, and 9 in Wayne County (Detroit).

Inflation, wages and the cost of groceries

Wages have grown faster than inflation on average over the last 14 years. However, during a brief 2-year period between 2021 and 2023, inflation spiked and that pain stuck with consumers for years. While the Federal Reserve and policymakers were able to bring that under control, the memory of it loomed large in Americans’ minds. This may be why 52% of Americans say they are financially worse off today than they were 4 years ago according to a recent Gallup Poll. They had apparently also forgotten about the tremendous wage growth during the pandemic.

But for low-income workers, those rising wages have not been sufficient. One of the most shocking statistics I have ever come across in this work is that the federal hourly minimum wage for workers who make tips is… $2.13. Before the pandemic, that could buy you a carton of eggs. But now, not so much. 43% of restaurant workers earn less than $30,000. When California increased the minimum wage for service workers in 2024, the day after the legislation was passed those same restaurants increased all the prices for their goods. This hurt those workers even more so because they typically rely on the cheaper fast foods at McDonalds, Chipotle, and Wendy's. Low-income families have been hit hardest by rising grocery prices. They spend 31% of their income on food, compared with 8% for wealthier families.

Bill Gates has no idea what is happening

If you’ve never seen this 2018 video of Bill Gates guessing the prices of regular supermarket groceries, it’s a must. It’s a fascinating snapshot into the disconnect that the ultra wealthy have from the cost of everyday goods. During a 1992 debate between George H. W. Bush and Bill Clinton, Bush had to admit that he had no idea what the price of milk was, a gaff that hurt his campaign for months. In the beginning, Ellen Degeneres explains that for every product he guesses correctly within a dollar, the audience will win a prize (applause from the audience), and if he guesses every price correctly, Ellen will pay off all of his children’s student loans. “No danger there,” Gates quips.

Corporate profits are not to blame

Over the last 40 years, retail food prices had the largest increase that economists had ever observed. Prices rose 11% from 2021-2022. There is a strong debate about the role that corporate profits have played in this price increase. On one

hand, operating profits of food and beverage retail stores rose from $14 billion in 2019 to $25 billion in 2023, a 79% increase. Two of the main drivers of this, according to researchers from the Federal Reserve, are rising commodity prices and people just buying more groceries.

Commodity prices soared when supply chains with Ukraine and Russia were disrupted during the war, as both countries are among the largest wheat producers in the world. Grocery stores charged higher prices to respond to the rising costs of their inputs.

At the same time, the pandemic created a groundswell of at-home chefs. People stopped eating out as much and learned to cook more. Instead of paying restaurants, they paid grocery stores. The number of customers shot up.

But large corporate grocery stores aren’t taking advantage of geopolitical turmoil or the pandemic as we can see from their margins. Grocery store margins remained unchanged from 2019 to 2023. If grocery stores were making 1 cent per carton of eggs at a price of $1.53 before the pandemic, they were still only making 1 cent per carton of eggs at a price of $3.53 after the pandemic. Reports from the Federal Reserve and the White House Council of Economic Advisers found that even when margins did rise in some areas, they largely tracked overall inflation or weren’t meaningfully contributing to the overall rise in prices.

Eggs won’t break the bank, but housing will

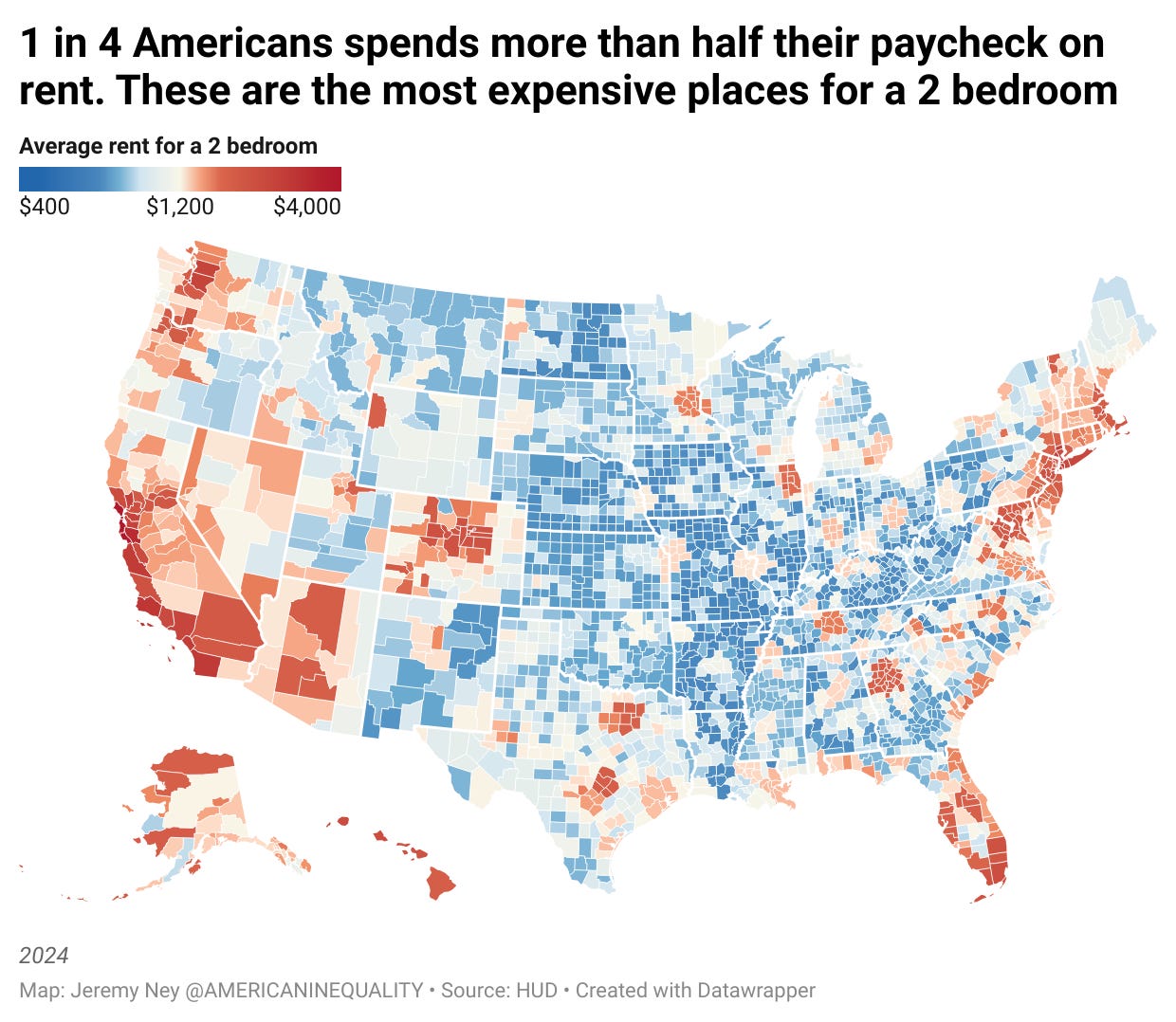

Housing is a much larger expense than groceries when it comes to cost of living, and this is really weighing on communities. 1 in 4 Americans spends more than 50% of their income on rent, despite the federal recommendation that no household spend more than 30% of their income on rent. 8 million people work multiple jobs and 400,000 work two full-time jobs, which still hardly covers the cost of a 2-bedroom in most states given the state minimum wage and the average rental cost. Groceries are an everyday pain, which can make rising prices feel bad. But eggs are unlikely to break the bank, especially since groceries are 13% of a person’s overall budget. The real culprit is housing.

Housing unaffordability is both a legacy of COVID and a policy choice. When global supply chains seized up during the pandemic, housing construction plummeted and prices rose. Now that the US has brought more manufacturing onshore and opened up new trade channels, policy decisions to maintain single-family zoning, parking minimums, and insufficient affordable housing stock measures have still hampered a housing rebound.

Renters have it the worst. Dennis Culhane, a professor of social policy at the University of Pennsylvania and specialist on housing spoke to us an shared, “Low income renters with severe rent burdens has reached record levels, affecting 8.5 million households. The problem is nationwide, but especially acute in areas like Seattle, Los Angeles, Denver, Miami and New York City.”

The Path Forward

Several factors led to price increases which were largely outside of US public, private, or nonprofit sector control. The war in Russia and Ukraine. The COVID-19 pandemic. Supply chain issues like in the Suez Canal and US ports. We need to put more money into people’s pockets while bringing down the cost of groceries.

⬆️ Raise the federal minimum wage to $15 - The current federal minimum wage of $7.25 was established in 2009 amidst the panic of the Great Recession. While 29 states have raised the wages above this, that leaves 31 states that rely on this floor. One of the primary arguments against raising the minimum wage is that it would increase unemployment. The Congressional Budget Office estimates that 1.4 million jobs would be lost from a $15 minimum wage — The argument goes that, with a fixed pie, employers would have to lay off workers to maintain their other workers at a higher rate. In the same paragraph though, the CBO also estimates that it would lift nearly 1 million people out of poverty and increase pay for low-income earners by $504 billion.

⛓️ Create private sector supply chain resilience: The #1 driver of the increase in grocery costs has been supply chain issues. Almost every activity after the food leaves the farm - transporting, packaging and processing food products - has contributed the lion’s share of rising grocery costs. One McKinsey report outlined specific steps for companies to diversify their suppliers and support better forecasting for ‘what if’ scenarios that seem to be far more common now. What if the port workers strike? What if we have a 100-year flood every 5 years? What if a bird flu wipes out production? This will not only ensure that grocery stores stay stocked, but that housing materials like lumber remain in adequate supply.

🏫 funding for New Markets Tax Credits - New Markets Tax Credits (NMTCs) have been one of America’s most successful policies for encouraging new development in underserved areas. Although NMTCs are not exclusively focused on food deserts, they have helped fund the creation of over 300 supermarkets in food deserts in recent years. 44 million people who are food insecure and 23.5 million live in food deserts. If America cannot support existing infrastructure or put more money into people’s pockets, new grocery stores in rural areas that might have higher costs due to transit or supply chains could help make food more affordable for those communities.

INTERESTING ON THE WEB

🏦 For the first time, just 4% of U.S. households are unbanked. A record low and down from a peak of 8.2% in 2011 - FinTech Collective

🗺️ VERY detailed map of how everyone voted in NYC. Does your city have something like this- The City

💸 Initial findings from a cash-infusion prescription program in Flint, Michigan for pregnant women and children in poverty. Effectively eliminated deep child poverty - GiveDirectly

How paperwork keeps people in poverty - Vox

📚 I’m writing a book! Follow along here for some more dedicated updates. I sent out my first note to readers this past weekend

Jeremy, I recommend listening to The Tenant Association podcast. Apparently a lot of rent-stabilized buildings across the country are coming to the end of their 30-year covenant deals and rent will go to market rate when that happens. Would love it if more could be shared about the impending rent crisis. More people should know about the scale of the problem and potential solutions / ways to organize.

More about the show here - https://earbuds.audio/blog/the-tenant-association-an-interview-with-phoenix-tso

Eggs are eggspensive. Brilliant. No notes.